Credit365 is a credit broker that operates in Moldova, Ukraine, and Kazakhstan. It connects borrowers with a network of lenders, helping them to find the best possible loan terms. Credit365 offers a variety of loans, including personal loans, car loans, and home improvement loans. The company also offers a credit card and a line of credit.

Overview

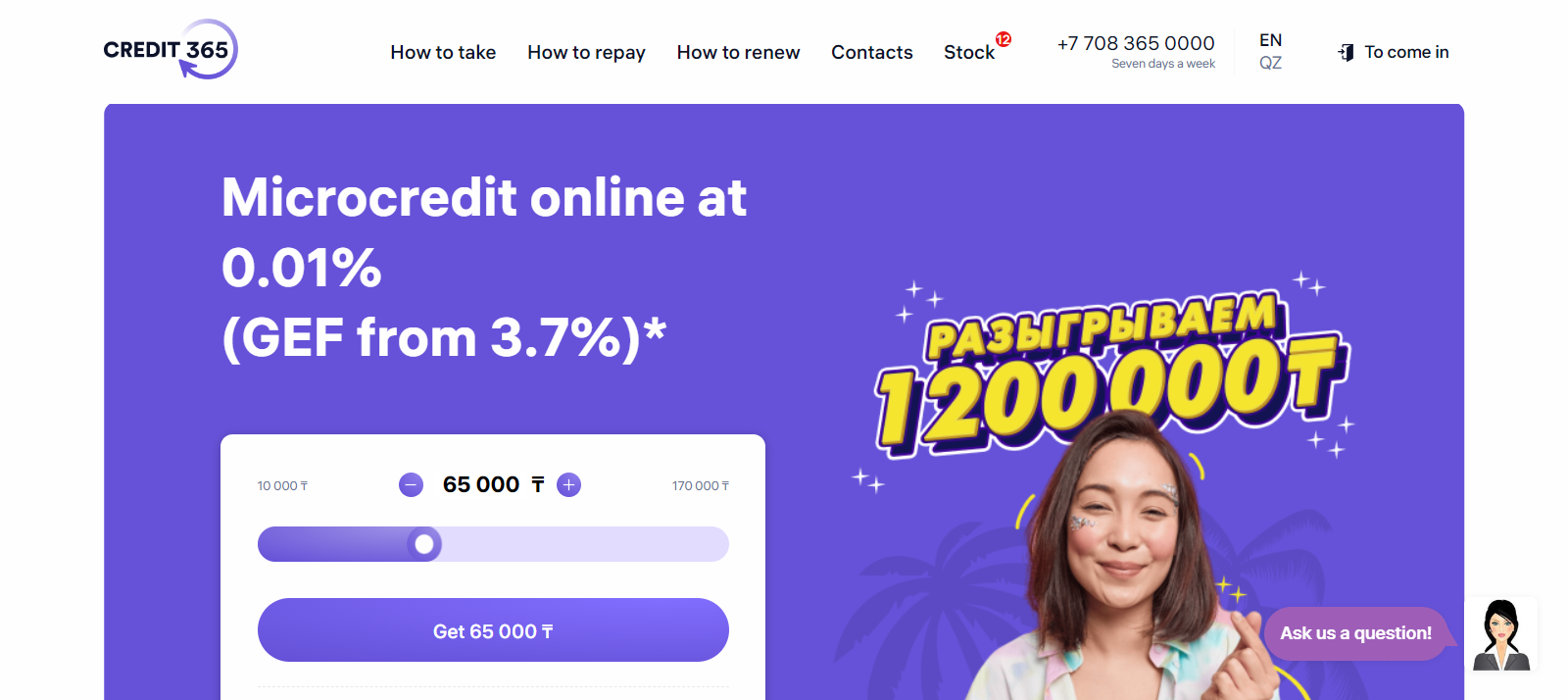

To apply for a loan from Credit365, borrowers need to provide some basic information, such as their name, address, and income. The company will then use this information to assess their creditworthiness and match them with a lender. The loan terms will vary depending on the borrower’s credit score and other factors.

If you’re struggling to make ends meet, a loan from Credit365 can help you get the credit you need to improve your financial situation. We offer a variety of loans, including personal loans, car loans, and home improvement loans. Our loans are designed to be affordable, so you can repay them without putting a strain on your budget.

Credit365 is a relatively new company, but it has quickly become one of the leading credit brokers in Moldova, Ukraine, and Kazakhstan. The company has a good reputation for providing fast and efficient service.

Get the Credit You Need to Improve Your Financial Situation

- You can borrow money to finance major purchases. Whether you’re buying a car, a house, or a business, credit can help you make the purchase without having to come up with all the cash upfront.

- You can build your credit history. When you make your payments on time, it helps to build a positive credit history. This can make it easier to get approved for loans and credit cards in the future, and it can also qualify you for lower interest rates.

- You can access better deals. Some businesses offer discounts and other benefits to customers with good credit. For example, you may be able to get a lower insurance rate or a better interest rate on a credit card if you have a good credit score.

- You can improve your financial flexibility. Having access to credit can give you peace of mind knowing that you have a financial cushion in case of an emergency.

If you’re looking to improve your financial situation, getting the credit you need can be a great place to start. However, it’s important to use credit responsibly. Make sure you only borrow what you can afford to repay, and always make your payments on time.

Here are some tips for getting the credit you need:

- Check your credit report. This will give you a good idea of your credit history and what factors are affecting your credit score.

- Get pre-approved for a loan. This will give you an idea of how much you can borrow and what the interest rate will be.

- Shop around for the best interest rate. Don’t just go with the first lender you find. Compare interest rates and fees from different lenders before you choose one.

- Only borrow what you need. Don’t overextend yourself. Only borrow what you can afford to repay.

- Make your payments on time. This is the most important thing you can do to build your credit history.

Build Your Credit Score and Improve Your Financial Future

Your credit score is a number that lenders use to assess your creditworthiness. It is based on a variety of factors, including your payment history, the amount of debt you have, and the length of your credit history. A good credit score can help you get approved for loans and credit cards at lower interest rates, which can save you money in the long run. It can also help you qualify for better deals on insurance and other products and services.

Here are some tips for building your credit score:

- Make your payments on time. This is the most important thing you can do to build your credit score.

- Keep your credit utilization low. Your credit utilization is the percentage of your available credit that you are using. Aim to keep your credit utilization below 30%.

- Pay down debt. The less debt you have, the better your credit score will be.

- Get a credit history. If you don’t have a credit history, you can start by getting a secured credit card. A secured credit card requires you to make a deposit, which is used as collateral if you don’t make your payments.

- Avoid opening too many new accounts at once. Opening too many new accounts can hurt your credit score.

- Check your credit report for errors. Errors on your credit report can damage your credit score.

Here are some additional things to keep in mind when building your credit score:

- Be patient. It takes time to build a good credit score. Don’t expect to see results overnight.

- Don’t give up. If you make a mistake, don’t give up. Just keep working to improve your credit score.

Get help if you need it. If you are struggling to build your credit score, there are resources available to help you. You can talk to a credit counselor or a financial advisor.

Where to Buy

- Online: There are many online retailers, such as Amazon, eBay, and Walmart. You can usually find a wider selection of products and better prices online.

- In-store: There are also many brick-and-mortar stores, such as Target, Best Buy, and Macy’s. You can usually find the products you need in-store, but the prices may be higher than online.

- Local businesses: There are also many local businesses that sell products. This can be a great way to support your community and find unique products.

If you are looking for a specific product, I can help you find it online or in-store. Just let me know what you are looking for and I will do my best to help you.

Price

The price of a product can vary depending on a number of factors, including the product itself, the retailer, and the location. For example, the price of a gallon of milk may be different at a grocery store than at a convenience store.

Here are some of the factors that can affect the price of a product:

- The product: The type of product can affect the price. For example, a luxury car will be more expensive than a budget car.

- The retailer: The retailer can also affect the price. For example, a product may be more expensive at a department store than at a discount store.

- The location: The location can also affect the price. For example, a product may be more expensive in a big city than in a small town.

- The demand: The demand for a product can also affect the price. For example, a product that is in high demand may be more expensive than a product that is not in high demand.

- The supply: The supply of a product can also affect the price. For example, a product that is in short supply may be more expensive than a product that is in abundant supply.

If you are looking for the best price on a product, it is important to compare prices from different retailers. You can also use online price comparison tools to help you find the best deal.

Here are some online price comparison tools:

- Google Shopping: Google Shopping allows you to compare prices from a variety of retailers.

- PriceGrabber: PriceGrabber is another price comparison tool that allows you to compare prices from a variety of retailers.

- Kelkoo: Kelkoo is a European price comparison tool that allows you to compare prices from a variety of retailers.

- ShopSavvy: ShopSavvy is a mobile app that allows you to scan barcodes to compare prices from different retailers.

Shipping & Returns

The shipping and returns policy for Credit365 may vary depending on the product and the location. However, here are some general information about their shipping and returns policy:

- Shipping: Credit365 offers free shipping on orders over a certain amount. For orders under the minimum amount, shipping charges will apply. The shipping time will vary depending on the location.

- Returns: Credit365 offers a 30-day return policy for most products. You can return the product for a full refund or exchange it for a different product. The return shipping will be at your expense.

Here are some additional things to keep in mind about the shipping and returns policy for Credit365:

- Some products may not be eligible for free shipping or returns. It is important to check the product’s shipping and returns policy before you make a purchase.

- The shipping time may be longer for international orders. If you are ordering from outside of Moldova, Ukraine, or Kazakhstan, the shipping time may be longer.

You may be responsible for paying import duties and taxes on international orders. If you are ordering from outside of Moldova, Ukraine, or Kazakhstan, you may be responsible for paying import duties and taxes on your order.

Deals & Discounts

Credit365 offers a variety of deals and discounts on its products. These deals and discounts can vary depending on the product and the time of year. However, some common deals and discounts offered by Credit365 include:

- Free shipping on orders over a certain amount.

- Discounts for students, seniors, and military members.

- Promotional codes that can be used to save money on purchases.

- Sales and clearance events that offer discounts on a variety of products.

- Rewards programs that can earn you points or cashback on your purchases.

You can find more information about the deals and discounts offered by Credit365 on their website or by contacting their customer service department.

Here are some tips for finding deals and discounts on Credit365 products:

- Sign up for their email list. Credit365 often sends out email newsletters with information about upcoming deals and discounts.

- Follow them on social media. Credit365 also posts about deals and discounts on their social media pages.

- Check their website regularly. Credit365 updates their website regularly with new deals and discounts.

- Use a price comparison tool. A price comparison tool can help you find the best price on a product, including any available deals or discounts.

Is credit365 Legit?

- The legitimacy of Credit365 is questionable. It is a credit broker that operates in Moldova, Ukraine, and Kazakhstan. It connects borrowers with a network of lenders, helping them to find the best possible loan terms. However, there are some concerns about the company’s practices.

- For one, Credit365 is not BBB accredited. The Better Business Bureau is a non-profit organization that rates businesses based on their customer service, ethics, and financial stability. Not being BBB accredited is not necessarily a sign that a company is not legitimate, but it is something to keep in mind.

- Secondly, there are a few negative reviews about Credit365 online. Some people have complained about the company’s high interest rates and fees. Others have said that the company was difficult to contact and that they did not receive the promised loan terms.

- Finally, Credit365 is not a regulated financial institution. This means that it is not subject to the same rules and regulations as banks and other financial institutions. This could make it more difficult to get your money back if something goes wrong.

- Overall, the legitimacy of Credit365 is questionable. There are some concerns about the company’s practices and it is not BBB accredited. If you are considering using Credit365, I recommend that you do your research and compare rates from different lenders before you make a decision.

Is credit365 Safe?

Whether Credit365 is safe is a subjective question, as there is no one-size-fits-all answer. Some people may feel that the company is safe, while others may not. There are a few factors to consider when making this decision, such as:

- The company’s reputation: Credit365 has a mixed reputation online, with some people reporting positive experiences and others reporting negative experiences. It is important to do your own research and read reviews before making a decision.

- The company’s regulatory status: Credit365 is not a regulated financial institution, which means that it is not subject to the same rules and regulations as banks and other financial institutions. This could make it more difficult to get your money back if something goes wrong.

- The company’s terms and conditions: It is important to read the company’s terms and conditions carefully before you apply for a loan. This will help you understand the risks involved and what you are agreeing to.

Here are some additional tips for staying safe when using Credit365:

- Only provide the company with the information that is absolutely necessary.

- Be wary of any unsolicited emails or phone calls from the company.

- Keep an eye on your credit report for any unauthorized activity.

- If you have any concerns, contact the company directly.

Pros & Cons

Pros:

- Fast and easy application process: You can apply for a loan from Credit365 online or over the phone. The application process is quick and easy, and you can usually get a decision within minutes.

- Wide variety of loans available: Credit365 offers a variety of loans, including personal loans, car loans, and home improvement loans. This can help you find the right loan for your needs.

- Competitive interest rates: Credit365 offers competitive interest rates on its loans. This can help you save money on your monthly payments.

- Flexible repayment terms: Credit365 offers flexible repayment terms, so you can choose a repayment schedule that works for you.

- No hidden fees: Credit365 does not charge any hidden fees. This means that you know exactly what you are paying for before you sign any paperwork.

Cons:

- Credit365 is a credit broker: Credit365 is a credit broker, which means that it does not lend money directly to borrowers. This means that you will still need to qualify for a loan from a lender.

- The interest rates and fees may be higher: The interest rates and fees charged by Credit365 may be higher than if you went directly to a lender.

- There is a risk of defaulting on the loan: If you default on your loan, you could damage your credit score.

- Credit365 is not BBB accredited: Credit365 is not BBB accredited, which means that it has not been reviewed by the Better Business Bureau. This could be a red flag for some people.

Customer Support

- Responsive Assistance: Our dedicated customer support team is available around the clock to assist you with any questions or concerns you may have. Whether you need help with a transaction, want to understand your credit card benefits, or require assistance with your account, our friendly and knowledgeable representatives are just a phone call away.

- Tailored Solutions: We recognize that every customer’s financial journey is unique. That’s why our customer support agents are trained to provide personalized solutions that cater to your specific needs. Whether you’re a first-time cardholder or a long-time member of the Credit365 community, we’re here to serve you.

- Quick Resolutions: We understand that time is of the essence when it comes to financial matters. Rest assured, we’re committed to resolving your issues promptly. Our efficient customer support team works diligently to ensure your concerns are addressed and resolved to your satisfaction.

- Educational Support: At Credit365, we don’t just assist with immediate concerns; we also empower you with knowledge. Our customer support team is well-versed in credit management and financial best practices. Feel free to reach out if you have questions about improving your credit score, managing your finances, or understanding the features of your Credit365 credit card.

- Feedback and Improvement: Your feedback matters to us. We actively seek input from our customers to enhance our services continually. If you have suggestions or ideas on how we can better serve you, please don’t hesitate to share them. Your insights are invaluable in helping us shape the future of Credit365.

Join the Credit365 community today and experience customer support that goes above and beyond to ensure your financial well-being. We’re here to assist you in every way possible, so you can confidently navigate your financial journey.

Conclusion

Credit365 is a credit broker that offers a variety of loans to borrowers in Moldova, Ukraine, and Kazakhstan. The company has a mixed reputation online, with some people reporting positive experiences and others reporting negative experiences. It is important to do your own research and read reviews before making a decision about whether or not to use the company.

The company’s regulatory status credit365 is not a regulated financial institution, which means that it is not subject to the same rules and regulations as banks and other financial institutions. This could make it more difficult to get your money back if something goes wrong.

The company’s terms and conditions it is important to read the company’s terms and conditions carefully before you apply for a loan. This will help you understand the risks involved and what you are agreeing to.

Leave a Reply